tax shield formula uk

While tax shields are used for tax savings for both personal and business tax returns this article focuses on tax shields for businesses. For more resources check out our business templates library to download numerous free Excel modeling PowerPoint presentation and Word document templates.

Wacc Formula Cost Of Capital Financial Management Charts And Graphs

Sum of Tax Deductible Expenses 10000.

. Issue cost 24m Amount of loan 50 m Normal borrowing rate 10 for 4 yrs Tax 30. The tax shield is a refundable tax credit that offsets a decrease in certain tax credits caused by an increase in your work incom Thursday April 21 2022 Edit. When calculating for the present value of Tax shield and subsidy benefit on a loan does one has to add the issue cost of the loan to the amount of loan.

Interest Tax Shield Formula. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. The effect of a tax shield can be determined using a formula.

Interest Tax Shield Interest Expense Tax Rate. Or the concept may be applicable but have less impact if accelerated depreciation is not allowed. If you have 1000 in interest expense for the year with a 35 percent tax rate your tax shield would be 350.

A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. A typical tax shield adjustment is that usually done in WACC calculations where the usual approach is to multiply the interest rate by. Tax Returns UK Property Foreign and more Partnership Tax Manager takes care of everything you need to submit your Partnership Tax return quickly and easily in time for the filing deadline.

Formula 19 is the most important result of this article since it gives the present value of the interest tax shields expected by a multinational firm whose free cash flow is a growing perpetuity. The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

Companies me mobile wallpaper. Approach to valuing the debt tax shield is simply to multiply the amount of debt by the tax rate in which case the debt tax shield would be seen as contributing 12 of total value. This is equivalent to the 800000 interest expense multiplied by 35.

1 1 - t Where t is the percentage tax rate. This gives you a good idea of the tax shield on that item. Tax Shield 10000 40 100 Tax Shield 4000.

Example of the. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. According to the No-costs-of-leverage theory the VTS is the present value of D T Ku not the interest tax shield discounted at the unleveraged.

A tax shield is the tax saving made by using debt rather than equity. PV of Tax Shield 1050m0303170-0909 2. Stated another way its the deliberate use of taxable expenses to offset taxable income.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. We therefore assume that the firms WACC is 15 the borrowing rate is given above. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

Mobile home roofing companies near me. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance Effective Tax Rate Formula Calculator Excel Template Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes Pdf Debt Tax Shields Around The Oecd World.

Tax Shield Deduction x Tax Rate. Calculating the tax shield can be simplified by using this formula. Since a tax shield is a way to save cash flows it increases the value of the business and it is an important aspect of.

Because of tax shields it is necessary to adjust the cost of debt when comparing it to the cost of equity. In this case straight-line depreciation is used to calculate the amount of allowable depreciation. Finch House 2830 Wolverhampton Street Dudley West Midlands DY1 1DB.

To calculate your tax shield first find the total cost of the deduction for the entire year then multiply that cost by your estimated tax rate. In this video on Tax Shield we are going to learn what is tax shield. And if the leverage ratio were doubled the debt tax shield could be shown to contribute almost a quarter of the value of the company.

As such the shield is 8000000 x 10 x 35 280000. Tax shield formula uk Tuesday March 1 2022 Edit. This reduces the tax it needs to pay by 280000.

Expressions for the present value of the tax savings due to the payment of interest or value of tax shields VTS. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. When You Want Your Home Or Business Looking Its Best Completely Protected.

A tax shield is a reduction in taxable income by taking allowable deductions. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. Taxshield is a trading name of Shield Products Limited.

Interest Tax Shield Average debt Cost of debt Tax rate. Tax shield formula uk. This is usually the deduction multiplied by the tax rate.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. PV if Tax Shield 1050m24m0303170-0909. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted average cost of capital WACC.

Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate. For example because interest on debt is a tax-deductible expense taking on debt creates a tax shield.

Free Cash Flow To Firm Fcff Formulas Definition Example

Weighted Average Cost Of Capital Wacc Formula Calculation Example

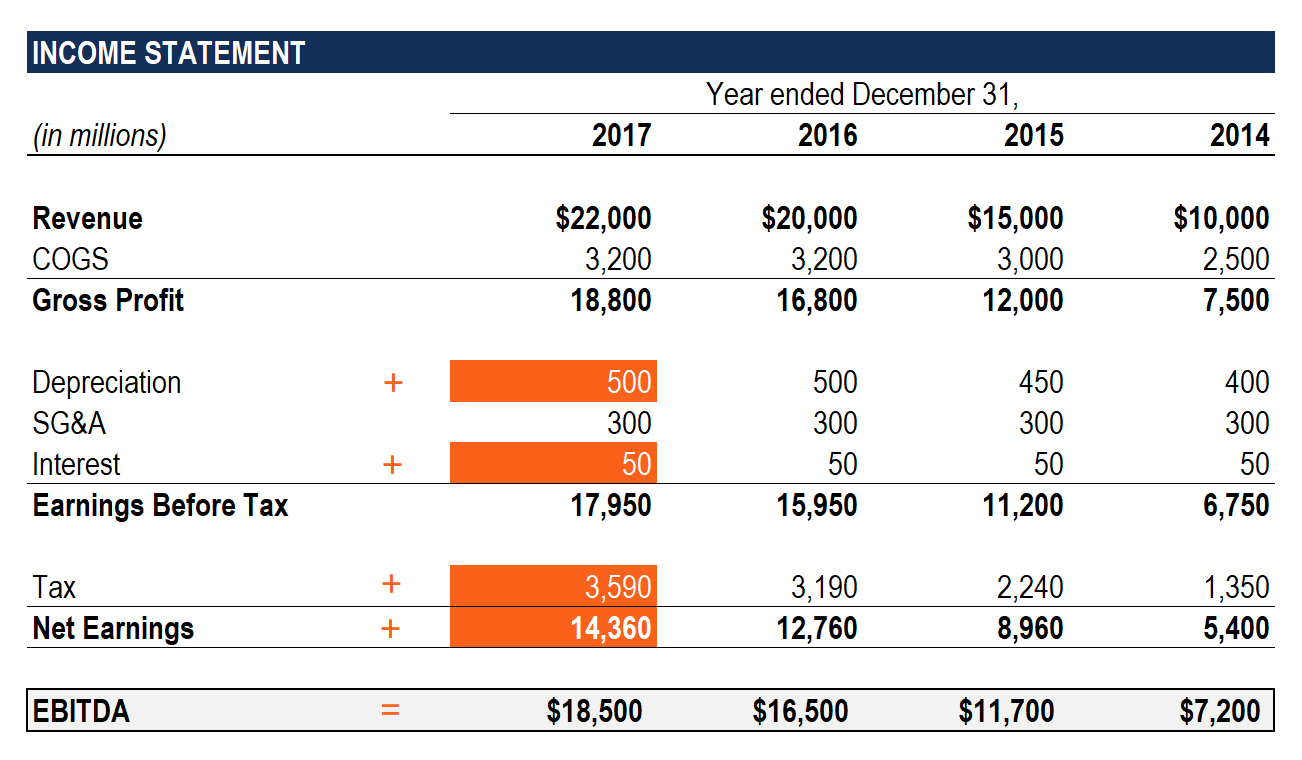

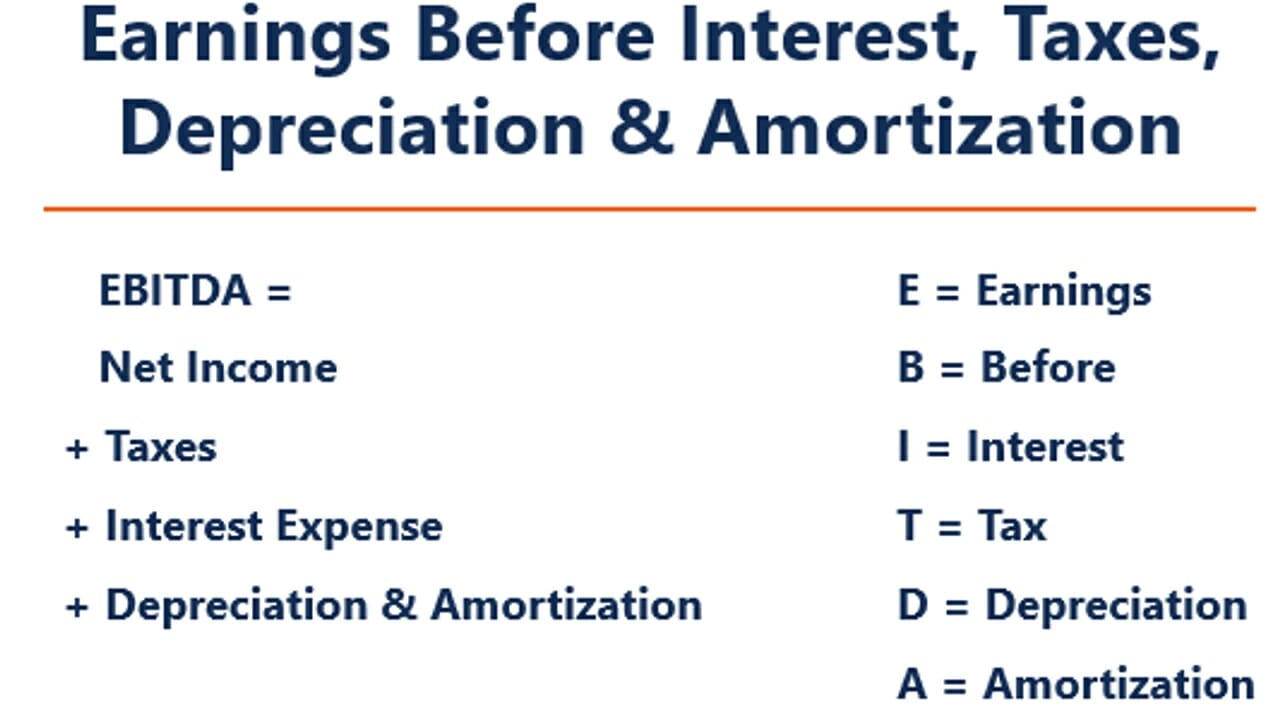

What Is Ebitda Formula Definition And Explanation

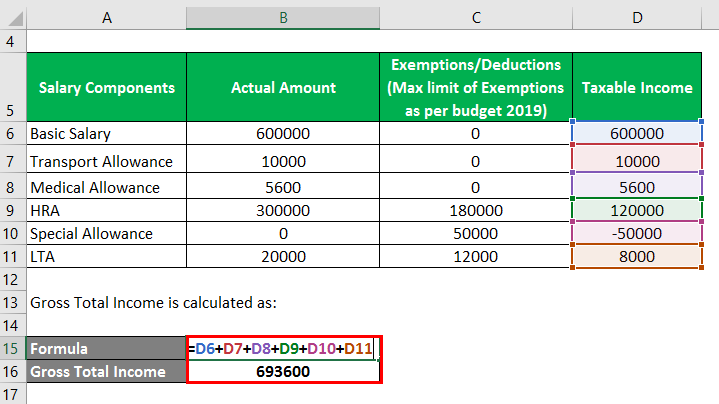

Taxable Income Formula Calculator Examples With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Capital Gain Formula Calculator Examples With Excel Template

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

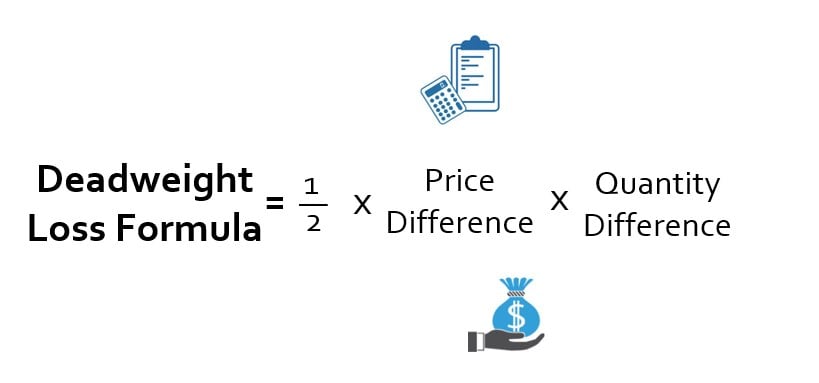

Deadweight Loss Formula How To Calculate Deadweight Loss

Unlevered Free Cash Flow Definition Examples Formula

After Tax Salvage Value Formula

What Is Ebitda Formula Definition And Explanation

Taxable Income Formula Calculator Examples With Excel Template

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)